lincoln ne sales tax rate 2018

Opry Mills Breakfast Restaurants. Notification to Permitholders of Changes in Local Sales and Use Tax Rates.

How To Register For A Sales Tax Permit Taxjar

The Nebraska state sales and use tax rate is 55 055.

. However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. Sales and Use Tax Rates Effective April 1 2017 Through September 30 2018. You can print a 725 sales tax table here.

Total 14 Cent Sales Tax Amount. McCook NE Sales Tax. Businesses Reminded That Public Safety Sales Tax Has Ended October 10 2018.

The 14-cent increase in sales and use tax was in effect October 1 2015October 1 2018. Lincoln NE Sales Tax Rate. Did South Dakota v.

You can print a 725 sales tax table here. The Nebraska state sales and use tax rate is 55 055. Ad Avatax automatically calculates sales and use tax for transactions invoices other.

TAX RATE FACTS Lincoln Tax Rate 0316 63 City loaned Tax Authority for Jail JPA 0018 4 Unutilized Tax Authority 0166 33. 025 lower than the maximum sales tax in NE. The Nebraska state sales tax rate is currently 55.

Lincoln Ne Sales Tax Rate 2018. This is the total of state county and city sales tax rates. The Lincoln sales tax rate is 175.

The 2018 United States Supreme Court decision in South Dakota v. Mayor Thanks Community for Success of Public Safety Sales Tax October 3 2018. Groceries are exempt from the Lincoln and Nebraska state sales taxes.

Income Tax Rate Indonesia. For more information see these media releases. Includes the 050 transit county sales and use tax.

Delivery Spanish Fork Restaurants. Additional Funding From LFR. Lincoln NE Sales Tax Rate.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Current Local Sales and Use Tax Rates and Other Sales and Use Tax.

The County sales tax rate is 0. Soldier For Life Fort Campbell. December 3 2018.

For tax rates in other cities see Nebraska sales taxes by city and county. Has impacted many state nexus laws and sales tax collection requirements. 800-742-7474 NE and IA.

Essex Ct Pizza Restaurants. Tax authority under statute. 2018 Charitable Gaming Annual Report.

The Lincoln County sales tax rate is 0. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

La Vista NE Sales Tax Rate. Avalaras online sales tax software makes it easy to manage your business taxes. Restaurants In Matthews Nc That Deliver.

The current total local sales tax rate in Lincoln County NE is 5500. There is no applicable county tax or special tax. The 8 sales tax rate in Lincoln consists of 65 Washington state.

The Lincoln Sales Tax is collected by the merchant on all qualifying sales made within Lincoln. Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. The Nebraska sales tax rate is currently 55.

14 Cent Sales Tax Revenue City of Lincoln 14 Cent Sales Tax Safety Projects Inception through 02282022 Capital Improvement Projects Utilizing 14 Cent Sales Tax Increase. Lexington NE Sales Tax Rate. IRS Publication 3079 Gaming Publication for Tax-Exempt Organizations.

For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. To review the rules in Nebraska visit our state-by-state guide. Lincoln 175 725 0725 2-285 28000 Linwood 10 65 065 201-287 28245 Loomis 10 65 065 149-291 29085 Louisville 15 70 07 107-293 29260 Loup City 20 75 075 90-294 29470 Lyons 15 70 07 108-298 29855 Madison 15 70 07 113-299 30240 Malcolm 10 65 065 150-302 30345.

Taxation In The United States Wikiwand

Gross Receipts Location Code And Tax Rate Map Governments

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Corporate Tax In The United States Wikiwand

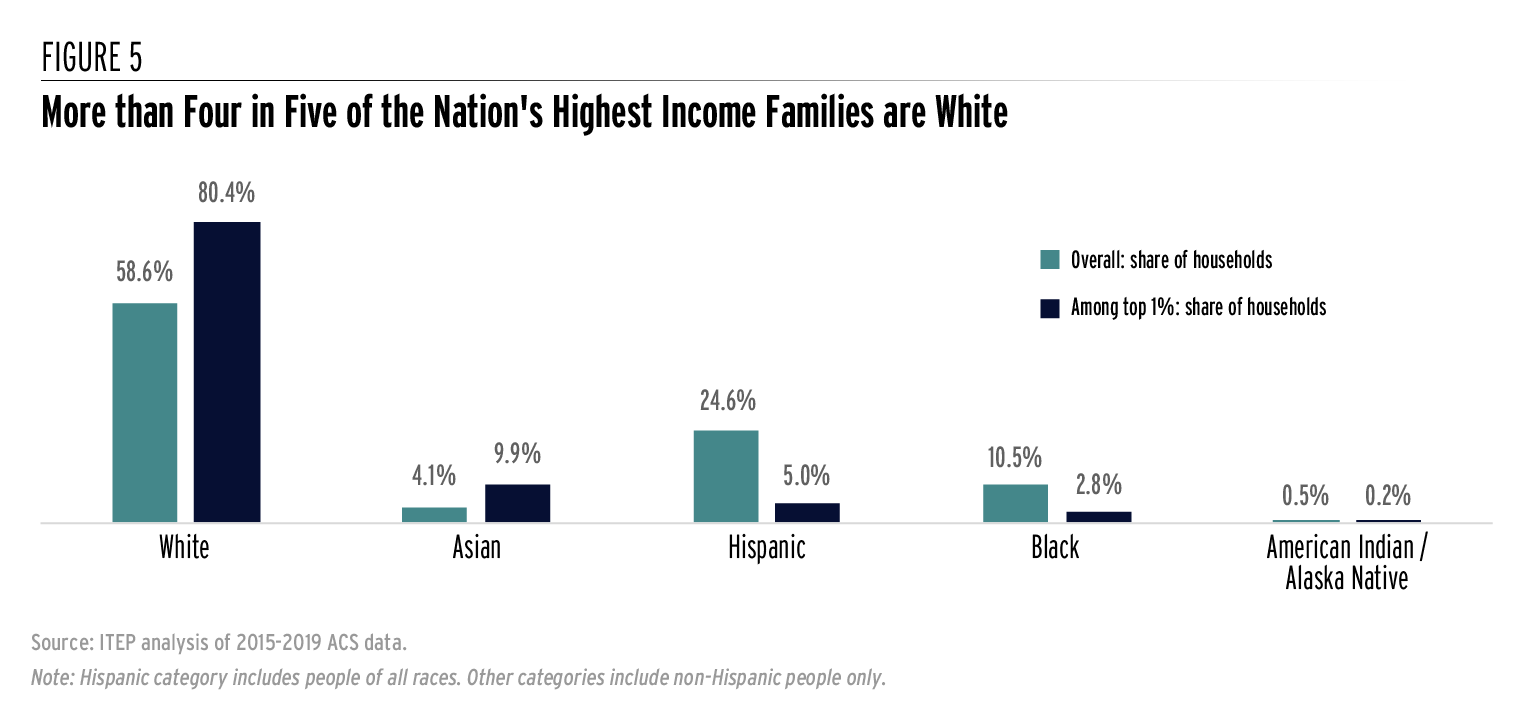

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

Why Households Need 300 000 To Live A Middle Class Lifestyle

Corporate Tax In The United States Wikiwand

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Why Households Need 300 000 To Live A Middle Class Lifestyle