south dakota sales tax rates by county

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Since sales tax rates may change we advise you to check out the South Dakota Department of Revenue Tax Rate page which has the current rate.

Sales Tax On Grocery Items Taxjar

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

. Tax rates provided by Avalara are updated monthly. The Lake County sales tax rate is. The South Dakota use tax was enacted in 1939.

The current sales tax rate is 45. There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814. Combined with the state sales tax the highest sales tax rate in South Dakota is 75 in the city of Roslyn.

Click Search for Tax Rate. The South Dakota retail sales tax was enacted in 1935 and extended to services and professions in 1965. In some locations a municipal tax may apply which is between 1 to 2 in.

At a total sales tax rate of 6500 the total cost is 37275 2275 sales tax. When calculating the sales tax for this purchase Steve applies the 4000 state tax rate for South Dakota plus 2500 for Aberdeens city tax rate. South Dakota amended it sales and use tax laws to conform with the Streamlined Sales and Use Tax Agreement in 2003.

31 rows The latest sales tax rates for cities in South Dakota SD state. The state sales and use tax rate is 45. If you need access to a database of all South Dakota local sales tax rates visit the sales tax data page.

South Dakota has a higher state sales tax. Automating sales tax compliance can help your business keep compliant with changing. A sample of the 385 South Dakota state sales tax rates in our database is provided below.

Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales. Has impacted many state nexus laws and sales tax collection requirements.

The most populous zip code in Miner County South Dakota is 57349. No credit card required. Skip to main content.

South Dakotas state-wide sales tax rate is 45 at the time of this articles writing with local surtaxes potentially adding on to that. A customer living in Aberdeen finds Steves eBay page and purchases a 350 pair of headphones. The one with the highest sales tax rate is 57349 and the one with the lowest sales tax rate is 57321.

Click any locality for a full breakdown of local property taxes or visit our South Dakota sales tax calculator to lookup local rates by zip code. Tax rates provided by Avalara are updated monthly. Like most states South Dakota has a blanket state sales tax rate of 45 that applies everywhere.

D Special taxes in local resort areas are not counted here. As far as other cities towns and locations go the place with the highest sales tax rate is Howard and the place with the lowest sales tax rate is Canova. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. C The sales taxes in Hawaii New Mexico and South Dakota have broad bases that include many business-to-business services.

While the sales tax in South Dakota is relatively low the state government relies on this revenue to fund public transportation education health care and other public services available to residents. Free automated sales tax filing for small businesses for up to 60 days. Enter a street address and zip code or street address and city name into the provided spaces.

As far as other cities towns and locations go the place with the highest sales tax rate is Deadwood and the place with the lowest sales tax rate is Nemo. The base state sales tax rate in South Dakota is 45. To review the rules in South Dakota visit our state-by-state guide.

The 2018 United States Supreme Court decision in South Dakota v. The most populous zip code in Lawrence County South Dakota is 57783. South Dakota Sales Tax Guide And Calculator 2022 Taxjar The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

This is supplemented in most parts of the state by local taxes that bring the total effective rate up to between 55 and 65. Find your South Dakota combined state and local tax rate. The base state sales tax rate in South Dakota is 45.

The tax data is broken down by zip code and additional locality information location population etc is also included. 366 rows Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. If you need access to a database of all South.

The one with the highest sales tax rate is 57732 and the one with the lowest sales tax rate is 57759. A few local jurisdictions in the state like Pine Ridge and Blackhawk dont add their own tax which means customers. Look up 2021 sales tax rates for Turner County South Dakota.

At a total sales tax rate of 6500 the total cost is 37275 2275 sales tax. For tax rates in other cities see Puerto Rico sales taxes by city and county. Laws associated with the 45 state sales tax can be found in SDCL 10-45.

Searching for a sales tax rates based on zip codes alone will not work. South Dakota Sales Tax. E Salem County NJ is not subject to the statewide sales tax rate and collects a local rate of 33125.

New Jerseys local score is represented as a. Look up 2021 sales tax rates for Turner County South Dakota. For additional information on sales tax please refer to our Sales Tax Guide PDF.

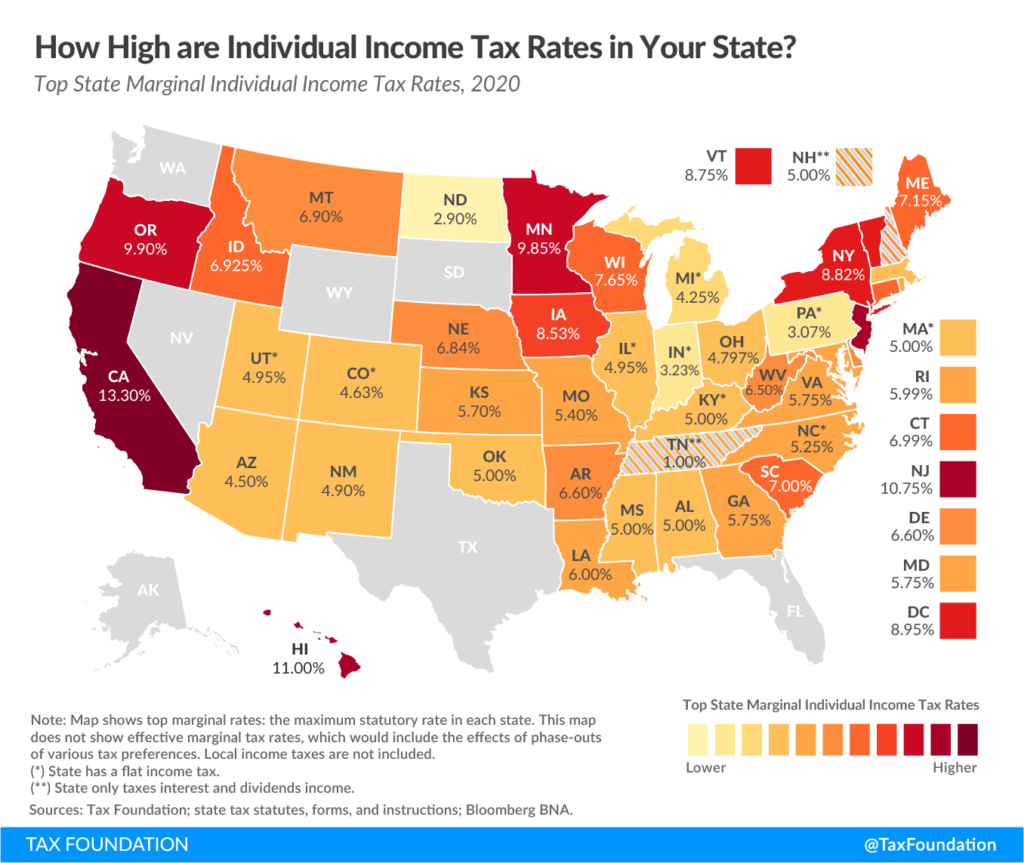

State Income Tax Rates Highest Lowest 2021 Changes

States With Highest And Lowest Sales Tax Rates

State Sales Tax Rates And Combined Average City And County Rates Download Table

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Updated State And Local Option Sales Tax Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

South Dakota Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

South Dakota Sales Tax Rates By City County 2022

Cannon S Canon Individual Income Tax Rates Across The Nation Utah Needs To Be More Competitive Utah Taxpayers

How Do State And Local Individual Income Taxes Work Tax Policy Center

Ranking State And Local Sales Taxes Tax Foundation

Income Tax Filings In These Counties Were Audited At A Lower Rate Than The Nation As A Whole Infographic Map Places In America Native American Reservation